Learn about your disability insurance (di) plan, a mandatory plan that provides a 70% income replacement when you are unable to work for long periods due to a totally disabling illness or injury. Disability and supplemental insurance plans that protect you against disability, sickness, injury, and maternity leave regardless of.

Get State Disability Instead Of California Workers

For federal employees under fers, a personal disability insurance policy allows you to more adequately protect yourself, your family and your future income by supplementing the percentage of income that fers does not cover.

Federal employee disability income insurance. Disability income for federal employees if youve been a federal employee for at least 18 months, you are covered by fers disability. In private disability insurance programs, each person must pay a monthly fee to remain eligible for disability insurance; Your employer offers two types of protection;

Whether you live alone or have a family, disability insurance assures that you are still able to take care of your responsibilities should you be injured or take ill for an extended period of time. There is short term disability and long term disability. Federal employee disability insurance benefits national alliance federal employee benefits (n.a.f.e.b.) offers federal and postal employees in the u.s.

But with opm disability retirement, in each and every paycheck that the federal worker has been receiving for all these long years of hard work, the federal employee already had to pay a deduction for regular and disability. Fedadvantage | supplemental disability insurance for federal employees. Accidental injury and disability income insurance helps protect you from the costs of accidental injuries while providing the security of disability income.

Having a comprehensive disability program is essential for all working employees, and federal employees are no different, although a disability income protection program can be difficult to find for federal employees. From requesting a quote to availing a custom package that fits all of your needs, we are your choice for all things related to supplemental insurance! How long could you go without a paycheck?

The purpose of disability insurance, whether for public or private employees, is as a type of income protection. There are no exams to take and no medical questions to answer. If you are out of work and have exhausted all of your sick and annual leave, your income from the federal government will stop.

Your employer offers two types of protection; All benefits paid directly to the policyholder; Its basically income workers would receive if they became injured and could not work.

As a federal employee you are on your own to find a plan that will help supplement your income in the event of an accident, sickness, or pregnancy. Outside of that, employees may be eligible for disability retirement benefits. We are an insurance agency here to help federal and postal employees with guaranteed issue disability, supplemental income plans & retirement planning through payroll deduction.

Benefits offered will account for this and also any existing individual disability insurance. Income plus is a voluntary group disability policy specifically designed for federal employees to help cover everyday living expenses and pay the bills if you cannot work due to an accident or illness. Fmla protects your job and access to health benefits for up to 12 weeks but the time off is unpaid.

Coverage must begin prior to conception. It provides you and your family with up to 65 percent of your basic monthly salary, with a maximum annual salary of $166,000 with starr wright usa's disability insurance for federal employees. Two coverage levels, including emergency room and ambulance benefits

Disability insurance replaces a portion of your income if illness or injury keeps you from working. As a federal employee, you do not have access to disability insurance through your employer. All insurers consider pregnancy a pre.

As a federal government employee, you have a gap in your disability coverage and the only way to properly protect your income is by obtaining an individual policy to supplement your group coverage. This disability plan will pay you directly in addition to your sick/annual leave. While you do have leave and disability retirement, these programs work as a base.

Federal employee benefits maternity leave. However, they can fall well short of what you may need if you were to suffer a prolonged disability. Michael relvas is an insurance specialist with mr insurance consultants, an insurance firm that provides personalized information, quotes and advice regarding life and disability insurance.

Federal employee disability insurance is very important for federal employees. Maximum number of years of service: Our firm works with a number of insurance companies that offer high quality disability insurance to federal workers.

We have offered supplemental insurance through payroll deduction from day one, now including aflac life coverage.

Did you know a state plan doesnt provide any benefits to

Pin by Harbour Health Insurance Solut on Monthly Wellness

Understanding Your Paycheck Stub Information, Earnings

The Top Five Personal Injury Causes PersonalInjuryLawyer

Dental Disability Insurance How to Find the Best Policies

12 Ways Social Security Has Drastically Changed Since Its

Sign Document (With images) Social security disability

Workers' Compensation Insurance as a State Requirement

Workers Comp Audit Stress Reducer Use It For Your Next

Health Insurance Infographics in 2020 Health insurance

Private Temporary Disability Benefits Disability benefit

Do I Qualify for Social Security Disability Benefits

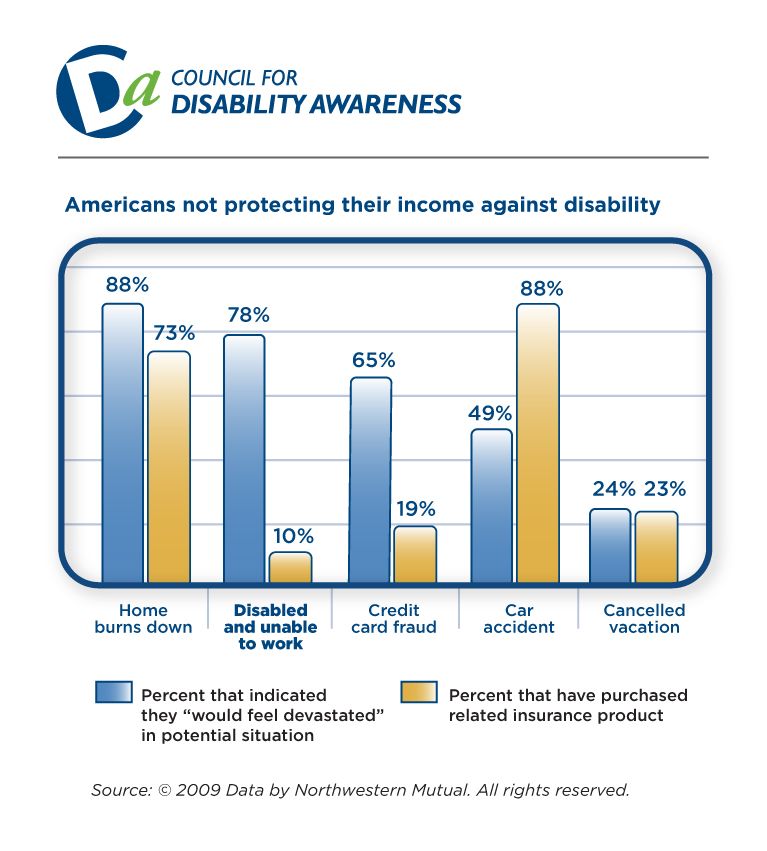

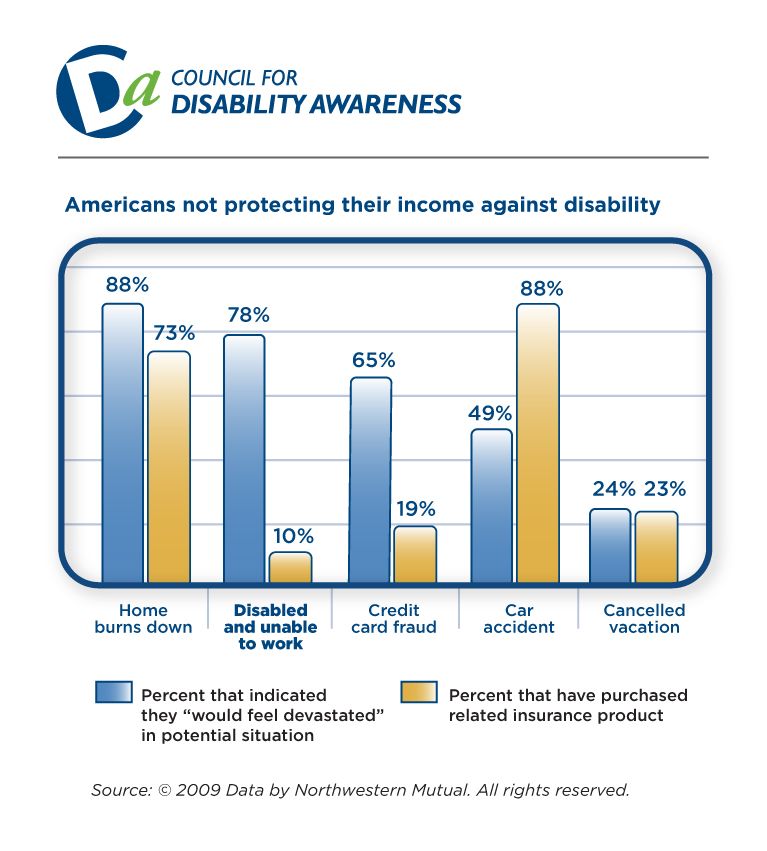

A third of workers are concerned about sick or

TDI Plans Insurance benefits, Disability insurance, How

disability insurance in Everett and Portland WA Term

Are you relying on Social Security for retirement? Maybe

Insurance Call Center Employee of the Year!!! (With images